The dream of home ownership is a common desire for most people. And to do so, housing finance is often used. And at that moment, comes a flood of terms, conditions and ways to hire.

This articule is by no means intended to make you an expert in financing, but rather to draw attention to some aspects that I think are important.

First point:

SAC or PRICE table?

Under the constant amortization system (SAC), installments are higher at the beginning and lower at the end because there is monthly amortization of the financed amount. The value of the installment decreases, from the first to the last, because there is a progressive decrease in interest

In the Price table (French amortization system), the installments start lower, but are “fixed” throughout the financing period.

The SAC system is preferable to the Price table because it represents savings of around 10%, on average. The advantage of the Price table is that the initial portion is usually much smaller. However, according to SAC, although the installments are higher at the beginning, there is a higher debt amortization, which leads to significant savings at the end of the financing.

However, we need to choose between the most advantageous system and the one that will fit the budget. This is where the Price table has the advantage, as it can be the watershed between buying or not the desired property.

Second Point:

Amortize the Term or the Installment Value?

Let’s first explain what amortization is. To pay off is to partially pay off a debt. In real estate financing, interest is paid on the outstanding balance (amount that is still needed to pay off a loan). Therefore, the more amortization, the less the buyer disburses with interest.

It is important to know that in each installment of the financing we have: Contractual Interest, Amortization, Insurance, Tariff and Fees.

When extra funds come in, you can advance payment to the bank, thus reducing your property’s outstanding balance. Then you will pay less interest and speed up the repayment of your loan.

When carrying out this operation, we have to make the following decision: reduce the term of the financing or the amount of the installment.

So, you ask yourself: what is the most advantageous way?

I’m not here to “invent the wheel”, as several thinkers have already done the calculations and proved that reducing the deadline would save you more. I just want to lead to a greater reflection on the other possibility: to deduct the value of the parcel. Precisely because I noticed that the same thinkers did not analyze this issue in any other way.

Suppose you follow the tip and pay off your mortgage, choosing to reduce the amount of installments. You could be getting a great deal. Mainly, taking into account that you have a steady job and the benefit is fitting in your pocket. That’s right, because have you ever imagined being unemployed? In this case, would you prefer to pay a smaller installment or have a reduced term? A smaller portion is less difficult to get the money, do you agree?

However, let’s think about it by looking at it another way. Let’s say you want to pay off this loan, paying it back whenever you have a little money left.

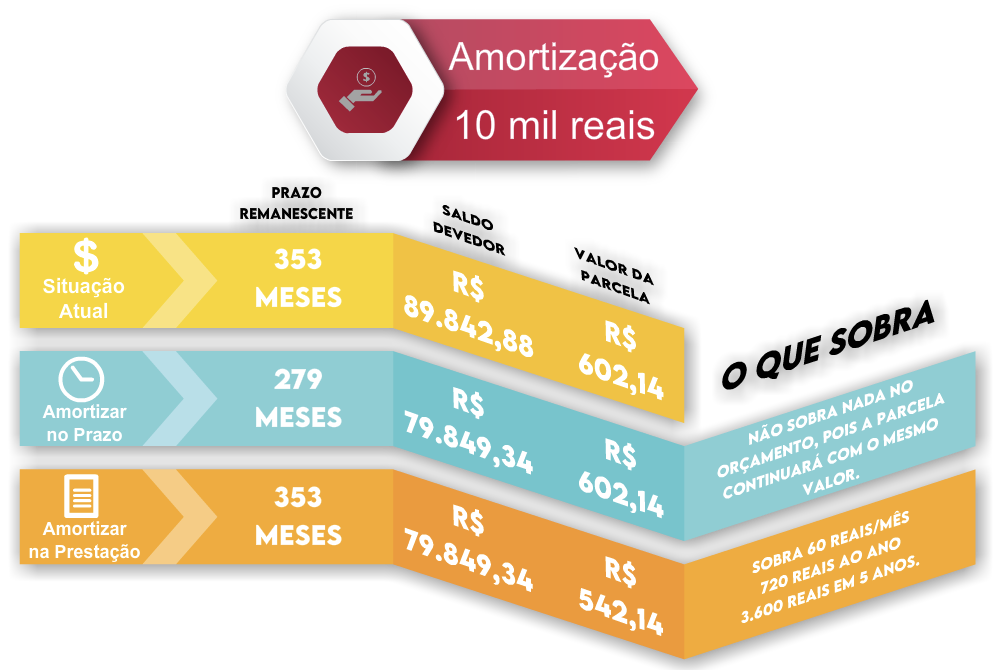

In the infographic below, we can follow a real simulation of amortization.

As can be seen in the infographic, in the amortization carried out by reducing the amount of the installment, 720 reais can be amortized every year (12 x 60 reais) which, in 5 years, would amortize, apart from the percentage of the installments paid in this period, plus 3,600 real.

So guys, did you find this way of looking at the amortization of housing financing valid?

Leave your opinions in the comments.

Hugs!

Erissom Amorim

2 comentários em “Using Math to financing your home in Brazil”